Harnessing the CREAM Model: A New Framework for Business Success

Introduction

Over the past 24 years, I’ve had the privilege of working with and learning from a diverse array of businesses across a dozen combinations of industry, location, and scale. My journey has taken me through restaurant franchises, multinational tech companies, and everything in between. From my early days working with franchise owners and later on with corporate chains, to my ventures in technology startups and agencies both in the USA and abroad, each experience has provided unique insights into what it takes to succeed at every level of business.

After reaching burnout in my last business, I started to ponder what made some businesses succeed and others struggle. What was it about Big Tech that allowed them to nearly effortlessly grow? Why did they seem to endure through the Innovator’s Dilemma when only a decade before this would have seemed unlikely?

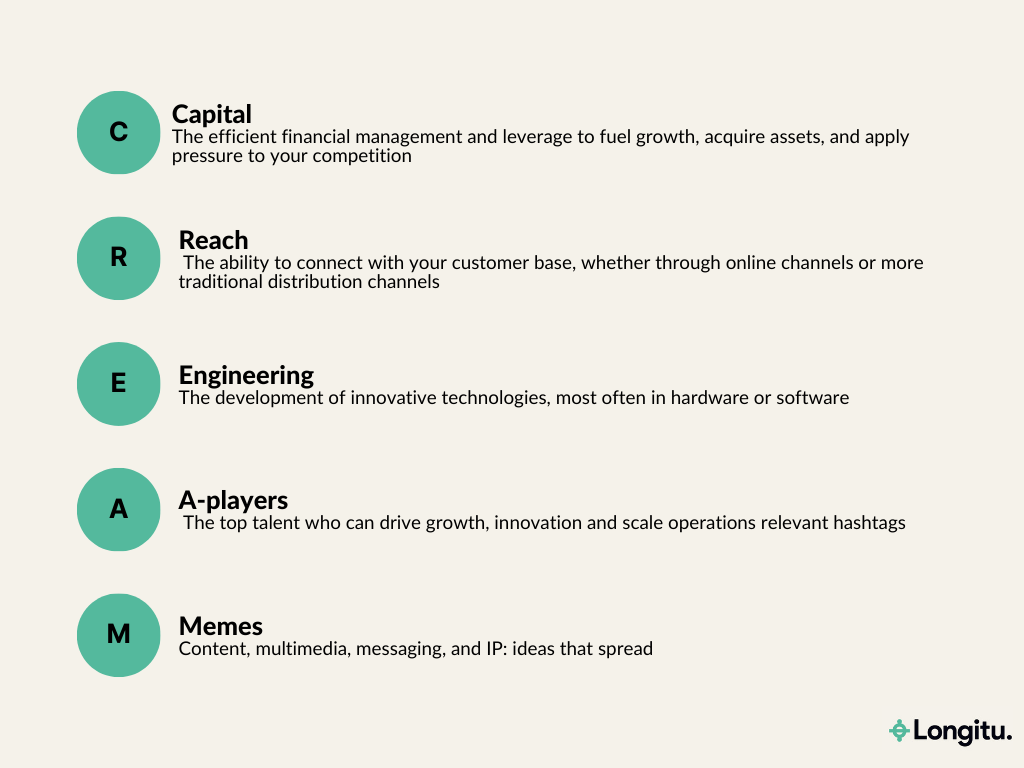

In this journey, a model emerged that I’m sharing here for the first time: the CREAM model of business leverage. The CREAM model includes five key points of leverage:

- Capital: the efficient financial management and leverage to fuel growth, acquire assets, and apply pressure to your competition

- Reach: the ability to connect with your customer base, whether through online channels or more traditional distribution channels

- Engineering: the development of innovative technologies, most often in hardware or software

- A-players: the top talent who can drive growth, innovation and scale operations

- Memes: the content, multimedia, messaging, and IP: ideas that spread

From the Big Tech players in Silicon Valley to the thriving nomadic Solopreneur in Thailand, the CREAM model predicts not success or failure, but something more important: whether your business can bring you joy or just a lot of pain, whether you need to endlessly grind or you can play in an infinite game.

In this series, I’ll share my insights from over two decades of experience in business and how the CREAM Model can unlock the full potential of your own company. As you explore this powerful framework, I hope that my personal anecdotes and lessons learned will illuminate the path to long-term success for you and your business.

The Importance of Business Leverage

“Give me a firm place to stand and a lever and I can move the Earth.”

Leverage can multiply your efforts and lead to exponential growth in business. By identifying and capitalizing on the key points of leverage in your organization, you can amplify your outcomes with less effort and resources. The CREAM model provides a clear framework to understand the most important points of leverage: Content, Reach, Engineering, A-players, and Money.

When businesses effectively apply these levers, they can unlock new opportunities, overcome challenges, and create a feedback loops that lead to rapid growth. By strategically employing each lever, businesses can create a competitive advantage that sets them apart from others in their industry.

Leverage is most often mentioned as financial leverage, but the concept applies equally well to the other four levers. Historically, just using 1–2 of these levers was enough. A restaurant in the right location (Reach) with a good Chef (A-player) could make a nice family business.

With the Internet, however, the game permanently changed. Finding and applying these points of leverage is now a necessity: every industry is getting consumed by companies maxing their leverage in all five areas. In the future, you may need fluency in all five just to survive.

How Amazon and Netflix use CREAM to destroy their competition

Consider the remarkable story of Amazon, a company that has mastered the five levers to become one of the world’s most valuable companies. In its early days, Amazon focused on Content and Engineering, building an effective e-commerce site to sell books. As the company grew, it continued to push on its levers:

- Capital: Throughout its history, Amazon has cleverly used finance to its advantage. FBA is effectively a Finance play, offering reach to third parties in exchange for free inventory. Amazon cleverly avoided profitability for most of its life, avoiding taxes while growing faster. And now it offers its own credit card to increase purchases. And it used its leverage in finance to acquire Whole Foods, itself a major point of Reach that lacked leverage in Engineering.

- Reach: as Amazon’s reach to customers grew, it started the FBA program to sell reach to others.

- Engineering: Amazon not only scaled its website to be the largest e-commerce platform in the world; it developed a services architecture that made it possible to sell AWS to other companies.

- A-players: Amazon focuses on hiring the best talent for positions of leverage, while ignoring talent in mundane jobs where A-players offer less leverage.

- Memes: starting with other people’s books, Amazon became a publisher of books, and movies.

Netflix is another example of a company that has successfully adopted all five levers. Originally a DVD rental service, Netflix also focused on having the largest supply of Content in the world to beat its offline competition. As they grew, they pushed further into the other levers to expand:

- Capital: cheap money allowed Netflix to aggressively move into the content creation space, competing with studios that had enjoyed multiple decades of leadership, This Content allows them to further grow the subscriber base and increase their Reach.

- Reach: as they increased their subscriber base, Netflix established leverage in Reach which enabled them to acquire better content; actors and directors willingly produced content that could be promoted through the Reach of Netflix.

- Engineering: machine learning enabled the original Netflix algorithm, and Netflix streaming was released many years before any significant competition.

- A-players: Netflix leveraged its unique culture and cash-based comp offers to acquire some of the best talent in Silicon Valley for the least tech looking company in the Big Tech cluster.

- Memes: from paying for DVDs, Netflix pushed into licensing content and then producing their own.

Both Amazon and Netflix demonstrate the power in leveraging all five points of the CREAM model to drive exponential growth and success. By understanding and applying these principles, both companies grew from online retailers disrupting the middlemen to massive businesses and middlemen in their own right.

Unpacking the CREAM Model

At first glance this model might seem simple and obvious, but each lever contains a surprising amount of detail and insight into business models.

Capital Rules Everything Around Me: How Finance Fuels Growth and Establishes Moats

In recent years, we’ve seen an era of low inflation rates and abundant Venture Capital (VC) funding. This environment led to the rise of startups that leverage cheap money to fuel rapid growth and market dominance. Books like Blitzscaling highlight the opportunity to leverage Money with Engineering to grab market share and establish Reach. This period will be seen as one where Finance grew so important as to almost eat Software: with Cryptocurrency, this may still happen.

One of the most important aspects of financial leverage is the ability to create a competitive moat. Companies with cash-rich balance sheets often put the money to work by buying or destroying their competition:

- Google buys YouTube for $1.65B

- Facebook buys Instagram for $1B and WhatsApp for $16B

- Netflix “plateaus” its content acquisition at $17B through 2023

- Amazon invested $60 Billion in CapEx in just 12 months to build out fulfillment and shipping

Capital is often not enough: OpenDoor raised $1.9B to own the Reach for real estate by purchasing properties, only to get caught unprepared for rising interest rates and declining home sales. Uber raised $25.2B, only to IPO at $75B, about the same multiple you might get as a small agency.

But when you leverage Capital to accelerate other levers, it can be extraordinarily powerful.

Expanding Your Reach: Mastering Distribution Online and Offline

Why do millions (and soon Billions) of users generate free content for these platforms? The answer lies in the promise of Reach.

In 2001, years before Web 2.0, I wanted to sell a new energy drink to customers, but I didn’t have any customers. I went to a nearby gas station where I knew the owner, and he offered me a deal: I could freely promote my drinks in his refrigerator, but I had to offer these drinks to him for free, and he would only pay me for what was sold.

This was the traditional method of reach: retailers who controlled the Point of Sale could leverage their fiefdom against suppliers of products to sell.

With the Internet, the mechanics of Reach evolved, from centralized to decentralized and back to centralized.

Before the Internet, most businesses operated through a chain of Reach. A Screenwriter might sell a screenplay to a Film Studio, who would buy an option and then pitch it to production houses. The production company would then seek out distribution companies, who had deals with movie theaters throughout the world. Thus half a dozen chokepoints could take their piece of the pie in exchange for their unique Reach.

The Internet, at first, looked to replace these chains of Reach with direct connection: you could use the Internet much like Direct Mail, and have a 1–1 relationship with every customer, without anyone else extracting their pound of flesh.

Although some early users established positions to maintain such a relationship, most businesses today have to now operate through major Tech companies to gain reach. Companies such as Instagram, Facebook, Google, Yelp, DoorDash, and Amazon aggregated Reach to create a new form of leverage.

Such is the value of Reach that Elon Musk paid $44B for Twitter, a large channel of Reach that has so far failed to monetize as well as its competition. Musk, otherwise a master of gaining free reach, seems to have realized the untapped opportunity in acquiring such a large lever.

Engineering Excellence: Harnessing Technologies for Breakthrough Innovations

“Software is eating the world.”

Perhaps the most obvious point of leverage here is engineering: most of Silicon Valley is based on the incredible leverage of starting a software company, with the ability to write code that can be replicated infinite times for a marginal cost close to zero.

What is less obvious is the multiple methods to leverage technology.

- Amazon: builds the best e-commerce site to scale, develops AWS as a standalone business, creates Alexa as its own product, and buys more than 200,000 robots to work in their warehouses.

- Google: builds the best model for search engine rankings, acquires the AdWords to builds one of the best businesses of all time. Then creates and gives away Gmail, Google Docs, Google Maps, and Android to maintain its position.

- Apple: creates the best consumer hardware in the world with the iPod, then uses its position as the producer of iTunes to further establish itself as a distributor of Content. Later releases the first good smartphone and continues to produce free software for its ecosystem to maintain its position. Now has the best laptop processors on the market by a significant margin, which will allow it to maintain relevance as AI commoditizes most software.

Software is a major lever in most startups because of its disruptive nature, but most of Big Tech has endured by continuing to write software that creates new lines of business or protects their existing business.

A-Players: Unlocking the Full Potential of Top Talent

Attracting and retaining A-players — top talent who excel in their respective fields — is a critical point of leverage for most modern businesses. Many people can speak in platitudes about finding the best talent, but its worth noticing where this leverage is most useful and where it is wasted.

Most pre-internet businesses grew around Standard Operating Procedures, or SOPs, which started from the premise that they didn’t want to rely on top talent. McDonald’s, for example, have more than 150,000 corporate employees and another 2 Million workers in franchises. McDonald’s never assumed competence: instead, they focused on Reach and Cash, even baiting Franchise Owners into buying in on the premise that the Franchisee was an A-Player who could perform better than average.

In contrast, tech companies relentlessly focus on the leverage of A-players. Although the numbers have dropped this year, Apple made $2.7M per employee in 2022, while Alphabet made $1.49M. In contrast, the average McDonalds only generates $3M in total gross sales, or less net sales than a single employee at Alphabet.

Can a single A-player generate more value than an entire McDonald’s restaurant? For Big Tech, where the leverage can be magnified through other levers, the average employee generates more value than a McDonald’s.

The Power of Memes: Crafting Compelling Narratives and IP

At first glance you may think adding "memes" is a joke, but this may become the most important lever in the 2020s.

Since the advent of copyright law, most upside in memes was in intellectual property: something you can create once and sell many times, such as the likeness of Mickey Mouse. Before the internet, creators of memes would seek out owners of Reach in order to sell to customers.

With the internet, the leverage of memes has radically changed. First, User Generated Content (UGC) and P2P file sharing drastically lowered the cost of most media. While P2P has largely disappeared, companies like Facebook, Instagram and TikTok grew through infinitely free content generated by their users.

At first, companies like MySpace and Facebook leveraged free content between friends, while YouTube grew by sharing pirated IP. Over time, as content creators identified new streams of income other than direct content sales, these companies pivoted to offer Reach in exchange for effectively free content from their users. Thus emerged a new game, where millions of content creators effectively work on spec to create ideas that might spread on the major platforms.

From the perspective of large businesses, this worked out very well: Google, Youtube, Facebook, Amazon, and Instagram all consume endless supplies of free content from their users which they repackage to the rest of the network.

TikTok changed the paradigm. By using its own algorithm to focus on the most engaging content, rather than prioritizing who has the most reach on the platform, TikTok incentivized a generation to further refine their content to spread mimetically. Users don't just create their own content: they quickly copy any meme that is popular on the platform, in the hope that their version will win. The winner here, of course, is China, who now has unique insights into how to addict, engage, and persuade over 1 Billion users.

Why the CREAM Model Matters

Unlike most business models, The CREAM model actually predicts the success or failure of most businesses.

If your competition uses all five points of leverage, and you only use 1–2, you will at best be acqui-hired.

Most startups can be defined as a business with 1–2 points of leveraging actively searching for the rest.

WeWork was a pure finance play that raised money by pretending to have Engineering, Reach, and A-players. When those evaporated, so did the company valuation.

On the other hand, if you can find a market that only uses 1–2 points of leverage, and you have three, you can quickly become the market leader. If you have all five, you can own the entire market.

Instagram was a startup with capital, A-players, and engineering. Once they started collecting content and reach, Facebook acquired them to eliminate a threat.

The CREAM model predicts Uber’s failure to live up to their $120B pre-IPO valuation. While much of the market saw a disruptive player, and Uber had more leverage than taxicabs, the CREAM model demonstrates the limits to their business:

- Capital: Uber gained most of their market share with cheap money from SoftBank, and briefly tried even subsidizing driver’s vehicles. Lots of innovation here, just not enough in the other levers.

- Reach: Uber tried to establish reach, first through exclusive relationships with drivers, then through offering delivery of food and other goods. To date, they’ve failed to achieve success here, lacking any real moat or network effect compared to their competition.

- Engineering: Uber hoped to create a self-driving car that would replace all drivers, but so far this has failed to come to fruition. Without it, they have a good but not great position in engineering, no better than Lyft.

- A-Players: Uber likely attracted a lot of A-players in the industry, and poached many from Google. The trouble is they didn’t convert this leverage into a better offer.

- Memes: While Uber was a master of memes to lobby governments, they never found a method to create multimedia or content that they could sell directly.

The former CEO of Uber, Travis Kalanick, seems to have learned from this experience.

While the typical restaurant has at most two points of leverage (Reach and A-players), Travis is applying all five levers to disrupt them with CloudKitchens.

- Capital: Travis has always been talented at acquiring and leveraging capital. Here he is likely establishing dark kitchens globally and quietly capturing market share.

- Reach: where one restaurant can have strong reach based on its location and foot traffic, this is expensive. Travis is using the free reach of delivery companies like Uber Eats to scale with other points of leverage.

- Engineering: although there is no point of engineering explicit in this model, designing a kitchen to support multiple cuisines is a new idea that requires solving for the complexity while avoiding allergens and contamination. Logistics and construction, but still engineering.

- A-players: Travis is recruiting key talent from his days at Uber and requiring them not to disclose who they work for.

- Memes: a big insight of dark kitchens is the importance of online content vs offline content. A Thai restaurant needs an entire restaurant of thai furnishings, statues, and design. A dark kitchen only needs the right logo and photos of food. This insight allows one dark kitchen to produce food for ten different cuisines without sacrificing brand power.

One of the biggest looming failures for Solopreneurs is the lack of leverage.

The typical FBA seller creates free content on IG and gives cash away to Amazon to sell products they found on Alibaba. Like the McDonald’s franchisee, they bet that they are the A-player, and they can out hustle everyone else.

In reality, the average FBA has 1-1.5 levers compares to Alibaba's three and Amazon's five:

Other Lifestyle businesses often struggle in the same way.

Content marketing agency? Sells memes to get reach and hopes they can scale with SOPs. The lucky ones have some capital leverage with arbitrage of employees in other countries, or an enduring email list that gives them reliable reach. Most of them only have the bet that they are the “A-player”.

Micropreneurs in the Rob Walling style? They often have leverage in engineering, but their pricing and introversion usually doom them to minimal leverage in Capital, Reach, A-players, or Memes. As soon as someone replicates their code, they lose all remaining leverage.

OnlyFans thot? Surely they are an A-player, and they think they leverage Memes and Reach. But they are one angry scammer away from losing their account, and AI is rapidly commoditizing even their unique IP.

If you only have one point of leverage, you better hope your competition has zero.

Conclusion

In conclusion, the CREAM Model serves as a powerful framework for understanding and applying the key points of leverage in business: Capital, Reach, Engineering, A-players, and Memes. By analyzing and strategically employing each lever, businesses can unlock new opportunities, overcome challenges, and create a sustainable competitive advantage that sets them apart from their competition.

Learning from the successes and failures of tech giants like Amazon and Netflix, entrepreneurs and organizations can utilize the CREAM Model to navigate the ever-changing landscape of business and achieve long-term success. No matter the size or nature of your business, mastering these five points of leverage will serve as a guiding light in your pursuit of growth, innovation, and joy in the journey of entrepreneurship.

In any competitive environment, consider first how your points of leverage compare to your competition. If you have less, be wary.

In future posts, we’ll take a closer look at each point of leverage and how it can be adopted by more businesses. We’ll look more closely at some recent business failures, and evaluate popular business models.